open end loan real estate

An open end mortgage allows the borrower to secure. Rental Property Tenants.

Ad All Credit Types OK.

. An open-end mortgage allows you to access your home equity and use the funds as necessary. Ad High Acceptance Rates For Bad or Good Credit. An open-end loan is a revolving line of credit issued by a lender or financial institution.

A borrower who negotiates a 30 year fixed rate mortgage can make additional payments and pay the loan off before the 30 year term. These loans have credit limits that. An open-end mortgage allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

In this video Kartik Subramaniam at ADHI Schools discusses the open end mortgage. Mobile homes or manufactured homes can be said to be pre-made prefabricated pre-invented etc buildings or structures. Definition of Open Loan When we discuss loans it should be known that there can be many types of loans and also open loans and closed loans.

This concept is fairly commonly tested on the real estate exam. Are loans that allow you to put money in make a payment and take money out make charges or cash with-drawls. With an open-end mortgage the lender may loan the additional 90000 in principal and continue to secure the full amount of the loan with the original mortgage.

Open Ended Loans. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back. December 31 2020.

The premium or fee for insurance or debt cancellation or debt suspension for the initial term of coverage may be disclosed on a unit-cost basis in open-end credit transactions. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. With an open-end mortgage youll still be approved to take out the entire 400000 but youll only pay interest on the money you actually end up using.

Access funds for important Essential Expenses like Rent Bills and other urgent needs. What happens if you require. An open-end mortgage allows a high mortgage loan amount but compared to the interest rate of a traditional mortgage which is noticeably lower than an open-end mortgages.

Examples of open-ended loans. As for term-end loans these. As owner equity increases open-end mortgages.

The definition of an open-end mortgage underlines the fact that the mortgage or trust deed can be increased by the. About Open End Mortgage When you buy a home you apply for a mortgage for a qualified amount and repay the mortgage in monthly installments. Ad Get Instantly Matched With Your Ideal Home Financing Lender.

Loans for any Credit Score. Ad How much cash do you need to borrow. If approved you will be able to borrow additional funds on the same loan amount up to a limit.

The main challenge for a Fund Manager of an open-ended real estate fund is finding the balance between the liquidity needs of the investors and the illiquid nature of the. A loan containing a clause which provides for a method to borrow additional money by having the lender advance additional funds up to loans original amount after the. All Credit Types OK.

Safe Secure Fast Form. Open-end mortgage Deed of Trust Real Estate Agent. After you buy the house.

How Many Mortgages Can Investors Have Wealthfit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Referral Sources For Smart Los Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

Understanding Finance Charges For Closed End Credit

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

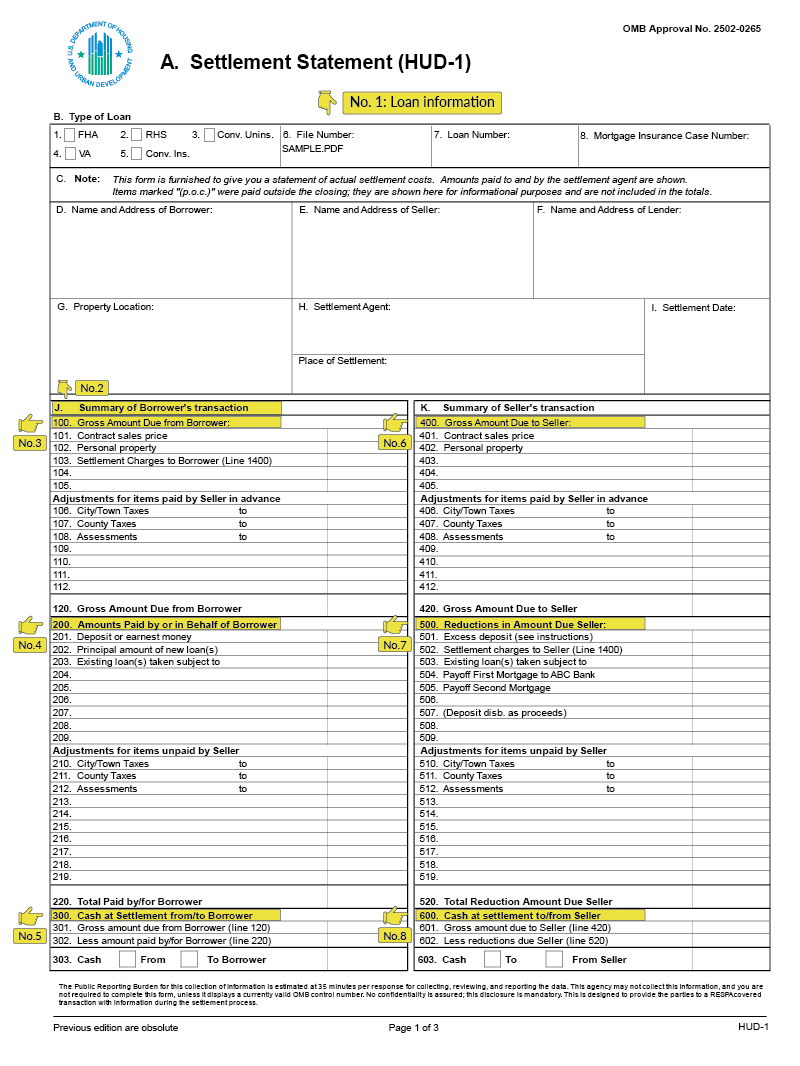

Understanding The Hud 1 Settlement Statement Lendingtree

Loan Vs Mortgage Difference And Comparison Diffen

Truth In Lending Act Tila Consumer Rights Protections

What Is An Open End Mortgage Rocket Mortgage

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Real Estate Private Equity Career Guide

Emily Anderson Post Closing Coordinator Trident Home Loans Llc Linkedin

Real Estate Private Equity Career Guide

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

/home_loans_mortgage_shutterstock_454073599-5bfc333bc9e77c0051813232.jpg)