oklahoma inheritance tax rate

Although there is no inheritance tax in Oklahoma you must consider whether your estate is large enough to require the filing of a federal estate tax return Form 706. An individuals tax liability varies according to his or her tax bracket.

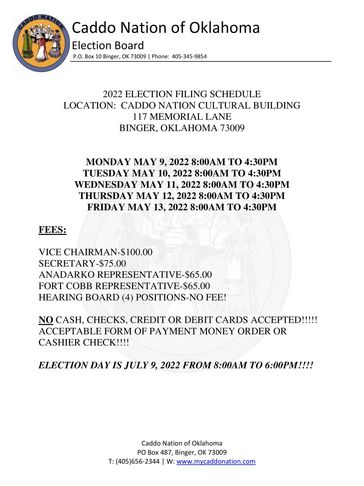

Oklahoma Probate Laws Important Court Timelines And Inheritance Advances

All Major Categories Covered.

. Key findings A federal estate tax ranging from 18 to 40. The top inheritance tax rate is 15 percent no exemption threshold oklahoma inheritance tax oklahoma estate tax. You can email David through our Contact.

Inheritance tax usually applies when. Postic is an attorney at Postic Bates PC. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. With proper estate planning a wealthy couple can. Select Popular Legal Forms Packages of Any Category.

In Oklahoma there are seven income tax brackets. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. A tax bracket is the income range to which a tax rate applies.

This helped provide clarity for Oklahoma estate planning. The personal income tax rates in Oklahoma for the 2015 tax year ranged from 050 percent to 525 percent. The 2018 Tax Reform Act has increased the estate tax exemption for 2018 to 112 million per person or 224 for a married couple.

Keep reading for all the most recent estate and inheritance tax rates by state. Oklahoma inheritance tax rate. The top estate tax rate is 16 percent exemption threshold.

Get a FREE consultation. Getting Help from An Oklahoma City Tax Planning Lawyer. His practice focuses on estate planning probate real estate trust administration business planning and adoption.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption There is no inheritance tax or estate tax in Oklahoma. Compare the best tax software of 2022. All new employers have an assigned tax rate of one and one-half percent 15 until sufficient experience history exists.

Oklahomas rate range is between 01 and 92 percent of Taxable Wage Base depending on Conditional Factor for the year. No estate tax or inheritance tax. The top estate tax rate is 16 percent exemption threshold.

No estate tax or inheritance tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Now the IRS Estate Tax Exemption and IRS Gift Tax Exclusion are updated annually.

6 rows State inheritance tax rates range from 1 up to 16. This is what is called Portability. Sales Use Rate Locator Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals Tax Preparers Software Developers.

Estates and their executors are still required to file the following. Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax.

Oklahoma On Pro Growth Property Tax Reform Ke Andrews

State And Local Sales Tax Deduction Remains But Subject To A New Limit Teal Becker Chiaramonte Certified Public Accountants

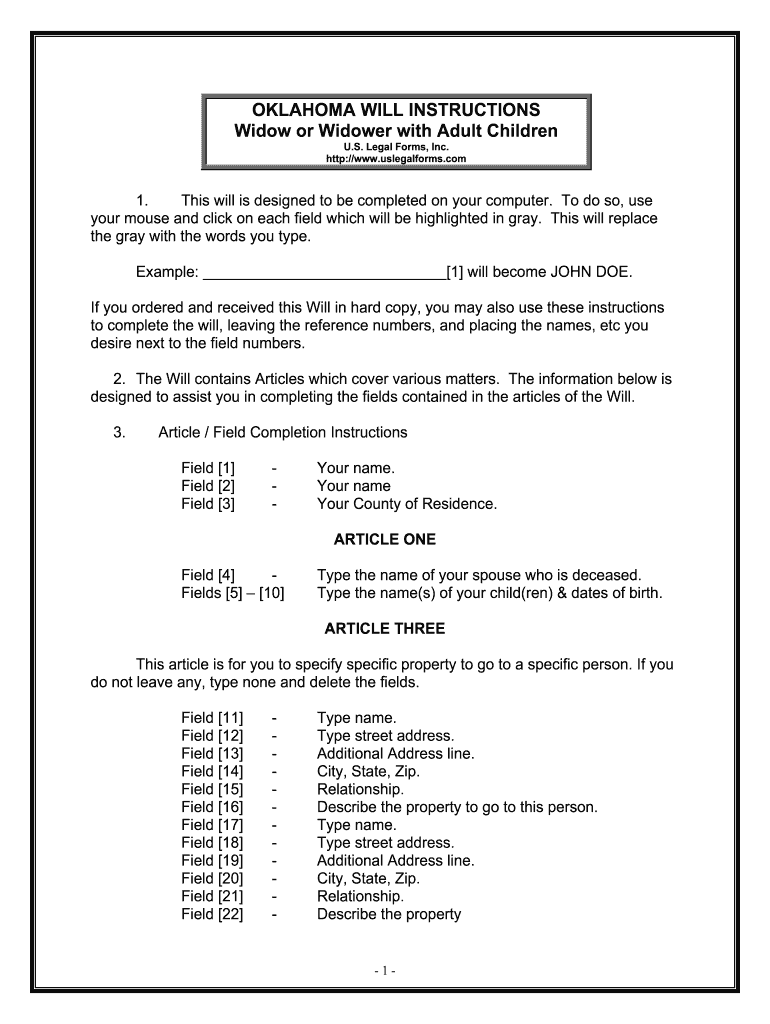

Oklahoma Will Instructions Will Samples And Guides Signnow

Should Oklahoma Expand Its Property Tax Caps And Exemptions Oklahoma Policy Institute

Oklahoma Health Legal And End Of Life Resources Everplans

Oklahoma Property Tax Calculator Smartasset

Is It Cheaper To Live In Texas Or Oklahoma Quora

Transfer A Deed When Parents Die Tulsa Probate Lawyers Kania Law

These Are The 10 Best Neighborhoods In Chicago To Live In Chicago Neighborhoods Best Places To Retire Chicago

Taxes Edmond Economic Development Authority

02 Governor Lee Cruce 1911 To 1915 Oklahoma Governors Oklahoma Digital Prairie Documents Images And Information